Owning an industrial residential property is a substantial financial investment. From shops to storage facilities, these structures are the heart of your organization. What takes place if something goes incorrect? Securing your financial investment with the appropriate insurance policy is vital. This overview will certainly damage down the fundamentals of industrial residential property structure insurance policy, assisting you comprehend what’s covered and what you ought to search for when picking a plan.

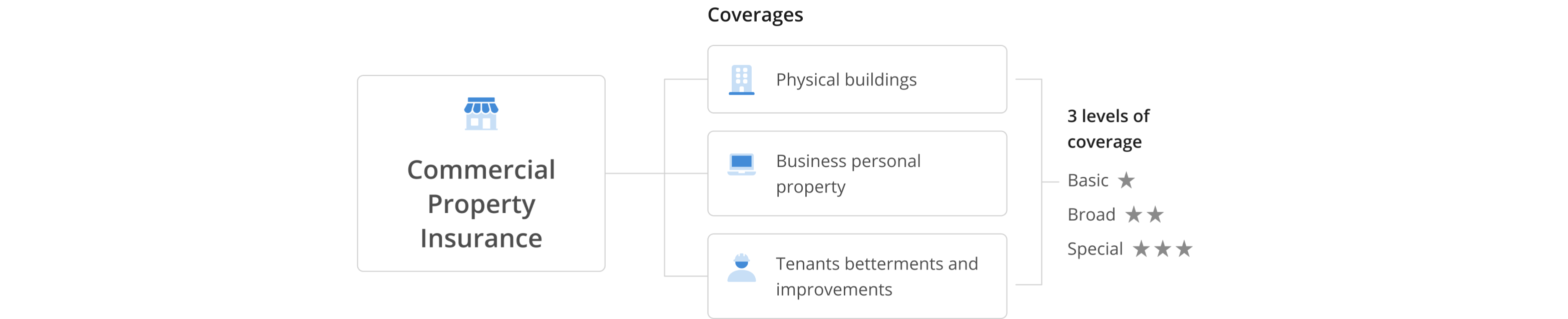

Understanding the Basics: Commercial residential property insurance policy exceeds just covering the structure itself. A detailed plan will generally safeguard versus a wide variety of hazards, consisting of fire, tornados, criminal damage, and also organization disturbance. Consider it as a safeguard for your whole procedure. It’s not practically the wall surfaces; it has to do with the resources of your organization.

Key Components of a Strong Policy:

- Coverage for the Structure: This covers damages to the physical structure itself, consisting of the roofing system, wall surfaces, and structure.

- Contents Coverage: Beyond the structure, your plan ought to safeguard the products inside, such as supply, tools, and home furnishings.

- Liability Protection: An essential facet, this covers prospective cases from 3rd parties hurt on your residential property.

- Business Interruption Coverage: If your organization is momentarily closed down as a result of a protected occasion, this insurance coverage assists with lost earnings and recurring expenditures.

- Additional Living Expenses (ALE): If the residential property is unliveable, this insurance coverage can aid cover short-lived living expenditures.

Beyond the Basics: Consider these elements.

- Deductibles: The quantity you pay out-of-pocket prior to your insurance policy begins. Reduced deductibles generally suggest greater costs.

- Policy Limits: The optimum amount the insurer will certainly spend for a protected loss. Evaluating these limitations is vital for ample defense.

- Endorsements: Special enhancements to your plan to cover details dangers or scenarios that could be distinct to your organization. If you have actually specialized tools, or carry out details tasks.

- Specific Peril Coverage: Make certain to examine your plan and comprehend the details hazards covered, as some plans might not cover all occasions.

Don’t Just Take Our Word For It: We motivate you to talk with an insurance policy specialist. They can examine your details demands and aid you locate the appropriate plan at the appropriate rate. A specialist can stroll you via the different choices and guarantee you’re totally safeguarded.

The Bottom Line: Protecting your industrial residential property is a financial investment in your organization’s future. By recognizing the parts of an extensive plan and dealing with an insurance policy specialist, you can protect your possessions and guarantee your organization can weather any kind of tornado.